Businesses in the European Union can check the VAT (value added tax) identification number (id) of their trading partners to make sure the companies are still operating, in business and the information provided is valid.

Our solution enables companies using SAP to automate the checks directly from their ABAP-based (ERP, CRM, SRM, S/4HANA) system.

Highlights

- Business-To-Government Communication (B2G)

- Turn-key Integration Content

- Automatic check of European VAT id based on the master data or single id

- Service Providers

- BZSt (Germany) – Bundeszentralamt für Steuern: Bestätigungsverfahren Umsatzsteuer-Identifikationsnummer (USt-IdNr.)

- VIES (European Commission) – VAT Information Exchange System: VIES VAT number validation

Prerequisites

- The government services are publicly available, no further charges apply

- Cloud Edition: You need an existing SAP Cloud Integration tenant where you can deploy our content. Please contact us in case you haven´t any.

Cloud Edition

Integration Content for SAP Cloud Integration

Configuration Guide for SAP Cloud Integration

- Import the ZIP Archive provided by Whitepaper InterfaceDesign into your SAP Cloud Integration Tenant

- Deploy both artifacts (Integration Flow & Value Mapping) without changing anything.

- In case you prefer certificate-based authentication from your SAP ABAP system, you have to change the Authorization in the SOAP Sender Channel from “User Role” to “Client Certificate”

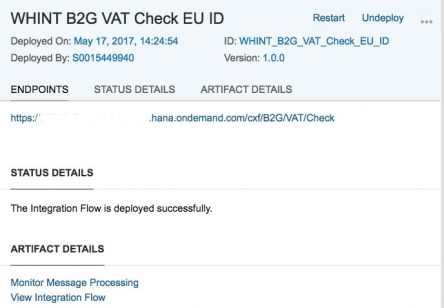

- Check the SOAP URL under Monitoring -> Manage Integration Content -> “WHINT B2G VAT Check EU ID” and note it down for the SAP ABAP system configuration

You can obtain the Integration Content here:

On-Premise Edition

Integration Content for SAP Process Orchestration

Configuration Guide for SAP Process Orchestration

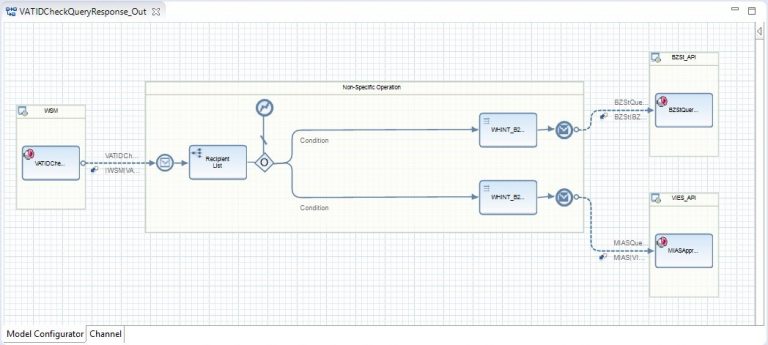

- Import the TPZ Archive provided by Whitepaper InterfaceDesign into your ESR

- Configure the iFlow/Integrated Configuration/Receiver Determination manually using the following artifacts of ESR Software Component “WHINT_VAT 2017.04 of whitepaper-id.com”

- Sender System: <Your SAP ABAP System>

- Sender Interface: VATIDCheckQueryResponse_Out (http://whint.de/xi/VAT/SAP)

- Sender Communication Channel: Apply Template

- Receiver Party: BZSt

- Receiver System: BZSt_API

- Content Based Routing: XPath //ProviderID=”BZSt”

- Operation Mapping: VATIDCheck_BZST (http://whint.de/xi/VAT/B2G/DE)

- Receiver Communication Channel: Apply Template REST_RCV_<version> (http://whint.de/xi/VAT/B2G/DE)

- Receiver Party: EuropeanCommission

- Receiver System: VIES_API

- Operation Mapping: VATIDCheck_VIES (http://whint.de/xi/VAT/B2G/EU)

- Receiver Communication Channel: Apply Template SOAP_RCV_<version> (http://whint.de/xi/VAT/B2G/EU)

- Content Based Routing: XPath //ProviderID=”VIES”

You can obtain the Integration Content here:

Configuration Guide: SAP Business Suite (ABAP)

- Import the ABAP Transport provided by Whitepaper InterfaceDesign by

- extracting the ZIP file into the directories /usr/sap/trans<data/cofiles>

- adding the transport via transaction STMS (Extras->Other requests->Add)

- On-Premise Edition SAP Process Orchestration

- no further setup necessary as long as your ABAP proxy runtime is configured to exchange data with your SAP Process Orchestration Integration Engine/Adapter Engine

- Cloud Edition SAP Cloud Integration

- Enter the “Web Service Configuration” (transaction SOAMANAGER -> Service Administration)

- Select Consumer Proxy “/WHINT/CO_VATIDCHECK_QUERY_RES”

- Create Logical Port (name e.g. “CPI”) as “Manual Configuration”

- Mark the Logical Port as Default

- Select the Authentication

- User ID/Password: (S-User which is enabled on your SAP Cloud Integration tenant with User Role “ESBMessaging.send”) or

- X.509 SSL Client Certificate

- Enter the URL under Transport Binding (URL Path, Host, Port, Proxy (If necessary))

- Select “Suppress ID Transfer” in Message ID Protocol

- Activate